14 December 2018

Bob Cunneen, Senior Economist and Portfolio Specialist

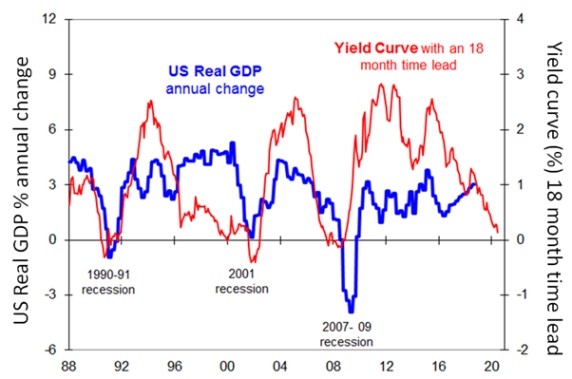

US economic growth vs yield curve

Source: Federal Reserve Bank of St Louis

Investors have become alarmed that the US yield curve indicates that a recession is coming. The ‘yield curve’ is the gap between long-term and short-term interest rates (red line). Currently the US yield curve is barely positive at only 0.15%, if one uses the gap between the US government ten year bond yield and the two year bond yield.

A falling yield curve is a worry. When the bond market pushes longer dated bond yields towards or below shorter term yields, this can signal that financial conditions are stressful and economic activity is set to weaken. Remarkably, a negative US yield curve has a great track record of predicting US recessions. In the last three US recessions starting in 1990, 2001 and 2007, a negative yield curve appeared before US economic activity slumped (blue line).

However US recessions have occurred with a considerable time lag after the yield curve goes negative. The time lag has varied between 13 and 22 months for the last three recessions. So the yield curve is a warning sign but not a clock. The potential causes and catalysts for the next US recession may still be in the making. Possibilities include the US central bank raising interest rates too high, the President’s impeachment, a global conflict or an energy crisis. Hence we cannot exactly forecast the timing of the next recession simply by the yield curve. All the yield curve signifies is that there is an economic and financial cycle that investors need to be wary of when looking at expected returns and risks.

Source : Nab assestmanagement December 2018

Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (“MLC”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060. An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the NAB Group. The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice). MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties. Past performance is not a reliable indicator of future performance. This information is directed to and prepared for Australian residents only. MLC may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.