Many small business owners place all their faith – and life savings –in their business. There’s another way. As we recover from the impact of COVID-19 on our economy and our lives, there’s never been a better time to take a fresh look at your money, reset your goals and renew your plans for the future.

For business owners, it’s a great time to start thinking beyond your business – to how your personal finances are tracking and what you might need to do to get or keep things on track. It’s easy to focus on your business finances – but all too often entrepreneurs neglect their own savings and wealth creation as they pour everything they have into their enterprise. This can be problematic as fewer than 5% of small business owners get owners close to or matching what they initially thought their business was worth1.

It’s hard to build wealth when your salary is small

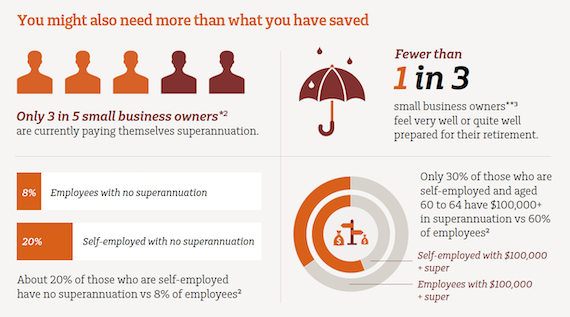

More than 2 out of 5 small business owners have a taxable income under $35,000 a year4. In addition to this there’s no doubt that Australia’s entrepreneurs are massively underinvesting in their own super – which is a big risk if your business sale doesn’t go as planned.

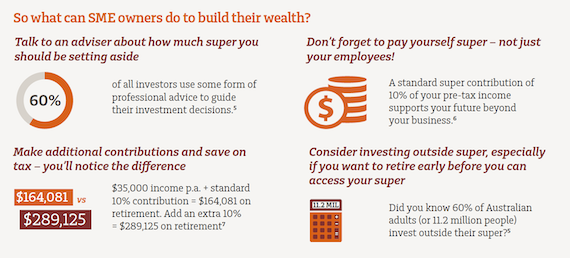

Below we have pulled together some top tips on how you can build your wealth.

If you would like to discuss your businesses financial future call us today Phone (03) 51 433 450

*59%

**30%.

1 https://www.afr.com/wealth/superannuation/the-mistakes-smes-make-when-it-comes-to-super-20160202-gmjo8u

2 http://www.superannuation.asn.au/ArticleDocuments/359/1803-Superannuation_balances_of_the_self-employed.pdf.aspx?Embed=Y

3 https://insidesmallbusiness.com.au/finance/one-in-four-small-business-owners-not-making-any-superannuation-contributions

4 https://insidesmallbusiness.com.au/finance/one-in-four-small-business-owners-not-making-any-superannuation-contributions

5 https://www.asx.com.au/documents/resources/2017-asx-investor-study.pdf?_ga=2.190522607.53036989.1499842294-253307695.1499842294

6 https://www.smallbusiness.wa.gov.au/blog/super-what-super

7 https://www.mlc.com.au/personal/retirement/am-I-on-track

Source: MLC

Important information and disclaimer

This communication has been prepared by Bridges Financial Services Pty Ltd ABN 60 003 474 977 AFSL 240837 (‘Bridges’) trading as MLC Advice, a member of the IOOF Holdings Limited ABN 49 100 103 722 (‘IOOF’) group of companies (‘IOOF Group’), registered office Level 3, 30 Hickson Road, Millers Point NSW 2000, for use and distribution by representatives of MLC Advice. MLC Advice financial advisers are representatives of Bridges.

Any advice in this communication is of a general nature only and has not been tailored to your personal circumstances. Accordingly, reliance should not be placed on the information contained in this communication as the basis for making any financial investment, insurance or other decision. Please seek personal advice prior to acting on this information.

If any financial products are referred to in this communication, you should consider the relevant Product Disclosure Statement or other disclosure material before making an investment decision in relation to that financial product. Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market.

Information in this communication is accurate as at the date of issue. In some cases, information has been provided to us by third parties. While it is believed the information is accurate and reliable, the accuracy of that information is not guaranteed in any way. Any opinions expressed constitute our views at the time of issue and are subject to change. While care has been taken in the preparation of this communication, subject to any terms implied by law and which cannot be excluded, no liability is accepted by Bridges, IOOF or any member of the IOOF Group, their agents or employees for any loss arising from reliance on this communication.

Any tax information provided in this communication is intended as a guide only and is based on our general understanding of taxation laws. It is not intended to be a substitute for specialised taxation advice or an assessment of your liabilities, obligations or claim entitlements that arise, or could arise, under taxation law, and we recommend you consult with a registered tax agent.

Please note that any advice you receive is provided by Bridges, not IOOF or any other member of the IOOF Group. An investment with Bridges, or any other member of the IOOF Group is subject to investment risk including possible delays in repayment and loss of income and capital invested. The repayment of capital, the payment of income and any particular rate of return are not guaranteed by Bridges or any member of the IOOF Group, or any other company, unless specifically stated in a current PDS. Neither Bridges, IOOF nor any member of the IOOF Group in any way stand behind the capital value and/or performance of any investment you may make as a result of the advice you receive.